Mastering ESG due diligence for sustainable investments

Identifying, assessing, and mitigating potential ESG risks during this phase will set up any company for success – but where to start? Are all LP requirements taken into account? Are they aligned with current (and potentially future) compliance? The following insight will guide you with the necessary steps along with hands-on action plans to land your deal.

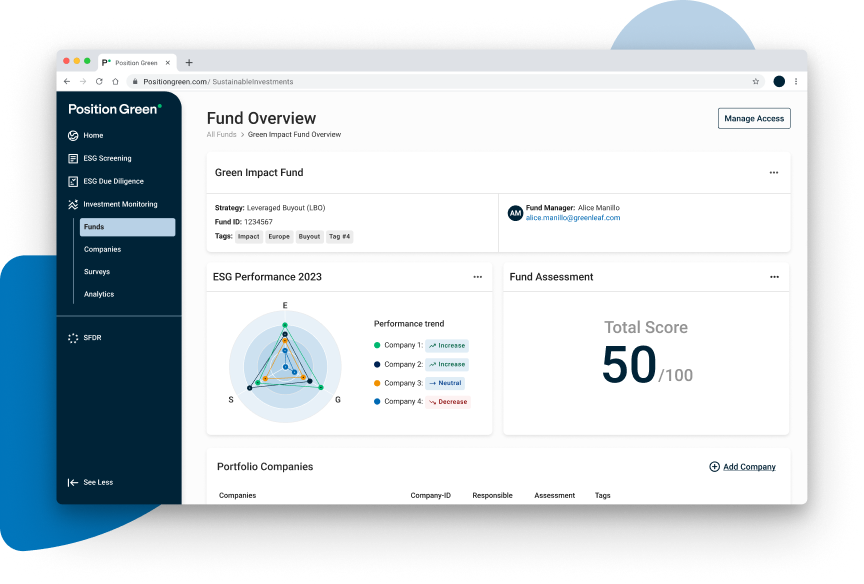

The importance of robust sustainable investment monitoring practices

Effective monitoring of sustainable investments involves the continuous evaluation of ESG performance throughout the investment lifecycle. This practice ensures that investments are aligned with sustainability goals and regulatory requirements, enabling investors to identify trends, manage risks, and optimise portfolio value. Given the increasing demand from LPs for sustainable products and ever-expanding ESG regulations, robust monitoring practices are essential for maintaining transparency and accountability.

Why thorough ESG evaluations matter for investors

ESG due diligence is a multifaceted process crucial for identifying, assessing, and mitigating ESG risks and opportunities. This process is not merely a checkbox exercise but a comprehensive evaluation that informs investment strategies and ensures alignment with sustainability goals.

- Advanced data collection and validation: Collecting high-quality ESG data is foundational to due diligence. Effective ESG software should streamline this process, allowing for the integration of data from various sources, such as surveys, third-party reports, and direct stakeholder engagement. The accuracy and granularity of this data enable investors to make informed decisions and develop targeted ESG action plans.

- Systematic risk assessment: Utilizing robust risk assessment frameworks allows investors to systematically identify and evaluate ESG risks. These frameworks help in understanding the potential impact of ESG factors on investments and developing mitigation strategies. By embedding these assessments into the due diligence process, investors can proactively manage ESG risks and leverage opportunities for value creation.

- Continuous monitoring and stakeholder engagement: Post-investment, continuous monitoring ensures that ESG objectives are met and compliance with evolving regulations is maintained. Engaging with stakeholders, including employees, customers, and communities, provides ongoing insights into ESG performance and areas for improvement. This engagement is crucial for aligning ESG initiatives with real-world conditions and expectations.

How to confidently generate long-term value in the due diligence stage

Position Green’s full-cycle investment software supports GPs and LPs during the entire investment cycle with complete transparency – from initial screening and ESG due diligence to portfolio management and exit readiness.

We also support organisations in carrying due diligence on their external partners to ensure quality and effectiveness.